Board Committees

Board Committees Our Board has four standing Committees: Audit & Risk, Finance, Management Compensation, and Nominating & ESG. Each of these Committees, other than the Finance Committee, consists exclusively of independent directors. The Chair of each Committee reports to the Board on the topics discussed and actions taken at each meeting. Each of these Committees operates under a written charter that includes the Committee’s duties and responsibilities. A description of each standing Committee is included on the following pages. Audit & Risk Committee Key Objectives: Our Board has four standing Committees: Audit & Risk, Finance, Management Compensation and Nominating & ESG. Each of these Committees, other than the Finance Committee, consists exclusively of independent directors. The Chair of each Committee reports to the Board in Chairman’s Session or Executive Session on the topics discussed and actions taken at each meeting. Each of these Committees operates under a written charter that includes the Committee’s duties and responsibilities.

A description of each standing Committee is included on the following pages.

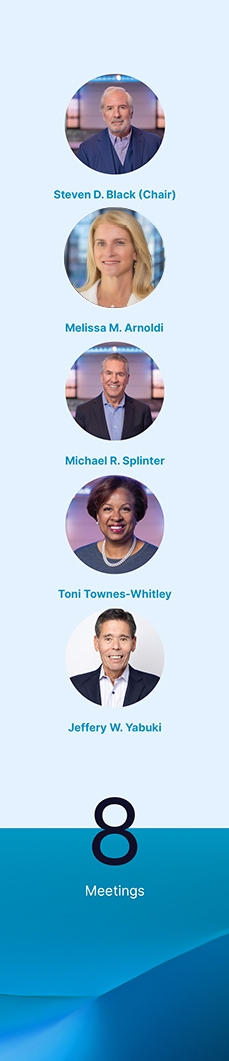

Audit & Risk Committee

Key Objectives:

·

| • | | Oversees Nasdaq’s financial reporting process and reviews the financial statements and disclosures in the Company’s Annual Reportsannual reports on Form 10-K, Quarterly Reports quarterly reports on Form 10-Q, and quarterly earnings releases. |

·

| • | | Appoints, retains, approves the compensation of, and oversees the independent registered public accounting firm. |

· Assists the Board by reviewing and discussing the quality and integrity of accounting, auditing and financial reporting practices at Nasdaq, including assessing the staffing of employees in these functions.

· Assists the Board by reviewing

| • | | Reviews the adequacy and effectiveness of Nasdaq’s internal controls.control framework and Sarbanes-Oxley compliance program. |

·

| • | | Reviews and approves or ratifies all related partyperson transactions, as further described below under “Certain Relationships and Related Transactions.” |

· Assists the Board in reviewing

| • | | Reviews and discussingdiscusses with management Nasdaq’s regulatory and compliance programs, ERM structure and process, Global Employee Ethics Program, and SpeakUp! Program and(which includes the confidential whistleblower process.process). |

· Assists

| • | | Reviews and discusses with management the Board in reviewingCompany’s Enterprise Risk Framework, including risk governance structure, risk assessment, and discussingrisk management practices and guidelines. |

| • | | Reviews and discusses with management the adequacy and effectiveness of Nasdaq’s cyber, privacy and technology controls.controls, including the Company’s Information Security program, and approves the Information Security Charter and Information Security Policy. |

· Assists the Board in its oversight of

| • | | Oversees the Internal Audit function, including approval of the annual Internal Audit Plan.plan, review of the function’s effectiveness according to industry standards, and discussion of the adequacy of budget and staffing. |

·

| • | | Reviews the appointment, replacement, removal, and remuneration of the Chief Audit Executive. |

| • | | Reviews and recommends to the Board for approval the Company’s regular dividend payments. |

| • | | Reviews and discusses with management the Company’s crisis preparedness regarding varied scenarios including geopolitical matters and cybersecurity incidents. |

34

2024 | Nasdaq Proxy Statement | OUR BOARD

2023 Highlights: 2021 Highlights:

| • | | Discussed information security topics, including the cybersecurity threat landscape, Nasdaq’s cybersecurity strategic plan, Nasdaq’s insider threat and vulnerability management programs, Adenza’s information security program, and the SEC’s cybersecurity disclosure rule. |

·

| • | | Engaged with certain third-party vendors that Nasdaq may use in the event of a cybersecurity incident involving the Company. |

| • | | Reviewed the pro forma financial statements for the Adenza acquisition and discussed the Adenza integration strategy. |

| • | | Received briefings on: Nasdaq’s tax profile; Nasdaq’s anti-corruption, anti-money laundering and sanctions compliance programs; Nasdaq’s litigation matters; Nasdaq’s revenue recognition policies; Nasdaq’s corporate insurance program; and the annual review of impairment testing. |

| • | | Conducted the annual review of the independent auditor relationship and recommended the retention of Ernst & Young LLP as the Company’s independent auditor. For further information on the Audit & Risk Committee’s review of the independent auditor relationship, see “Audit & Risk – Audit & Risk Committee Responsibilities – Annual Evaluation and 2022 Selection of Independent Auditors.” |

·

| • | | Approved Nasdaq’s policy on the use of non-GAAP measures and reviewed non-GAAP disclosures, impairment assessments and the impact or potential impact of changes in various accounting standards.· Approved the revised Supplier Code of Ethics and received an update on third

| |

|

| party risk management. disclosures. |

·• | | Reviewed the sanctionsReceived updates on third party risk management. |

Risk Oversight Role: | • | | Receives regular updates on risk matters from Group Risk Management and anti-money laundering compliance programs.other functions within Nasdaq. |

·• | | MonitoredApproves Nasdaq’s Risk Appetite Statement and recommends to the progression ofBoard for approval the Market Technology business’s clearing projects.Company’s ERM Policy. |

·• | | Discussed Nasdaq’s tax profile and tax planning in connectionReceives periodic reports on risk tolerances that measure management’s compliance with the Verafin acquisition.risk appetite. |

·• | | Received reports onReviews and discusses with management internal control and risk management frameworks designed to manage current organizational risks, including information security topics, including the software supply chain, the protection of market systems, IT asset management (including end-of-life governance and management) and vulnerability management.emerging risks. |

Risk Oversight Role:Independence:

·• | | Approves the Risk Appetite and reviews the ERM program, including policy, structure, and process. |

· | | Receives regular updates from the Chief Risk Officer on risk matters. |

Independence:

· | | Each member of the Audit & Risk Committee is independent as defined in Rule 10A-3, adopted pursuant to the Sarbanes-Oxley Act of 2002, and in accordance with the listing rules of The Nasdaq Stock Market. |

·• | | The Board determined that Mr. Kloet and Ms. Begley are “audit committee financial experts” within the meaning of SEC regulations and each also meets the “financial sophistication” standard of The Nasdaq Stock Market. |

| • | | In addition to serving as the Chair of the Audit & Risk Committee, Mr. Kloet also serves as the Chair of the Boards of our U.S. exchange subsidiaries and their Regulatory Oversight Committees. We believe this enhances the Audit & Risk Committee’s oversight of our U.S. exchanges. |

2024 | Nasdaq Proxy Statement | OUR BOARD

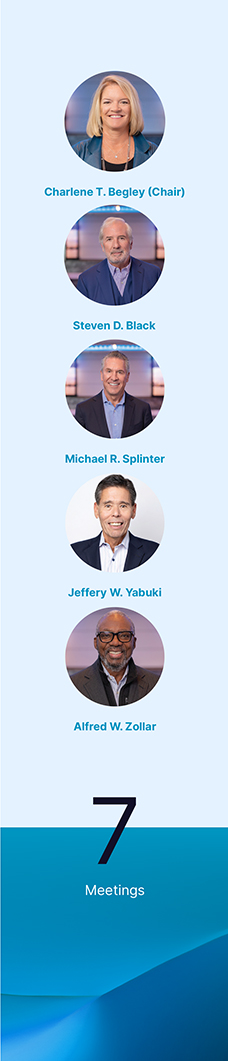

| | | Finance Committee Key Objectives: Key Objectives:

·

| • | | Reviews and recommends, for approval by the Board, the capital plan of the Company, including the plan for repurchasing shares of the Company’s common stock and the proposed dividend plan. |

·

| • | | Reviews and recommends, for approval by the Board, significant mergers, acquisitions, and business divestitures. |

·

| • | | Reviews and recommends, for approval by the Board, significant capital market transactions and other financing arrangements. |

·

| • | | Reviews and recommends, for approval by the Board, significant capital expenditures, lease commitments, and asset disposals, excluding those included in the approved annual budget. |

2023 Highlights: 2021 Highlights:

| • | | Reviewed and recommended Board approval of the Adenza acquisition and related financing, which included the issuance of approximately $5 billion in senior notes, a $600 million term loan, and approximately $290 million of commercial paper. |

·

| • | | Conducted a comprehensive review of the capital plan for Board approval.approval, including updates to the capital plan following the completion of the Adenza acquisition to reflect debt deleveraging and share repurchase commitments. |

·

| • | | Reviewed and recommended Board approval of Nasdaq’s entry into a multi-year partnership with AWSan increase to buildour share repurchase program to an aggregate of $2 billion, enabling the next generation of cloud-enabled infrastructure forCompany to continue share repurchases, including repurchases in the world’s financial markets.· Reviewed and recommended Board approval of the divestiture of Nasdaq’s U.S. Fixed Income business and an accelerated stock repurchase agreementfuture to offset longer-term dilution related tofrom the issuance of sharesequity issued in connection with the divestiture.

Adenza acquisition. |

·

| • | | Advised the Board on the 10% increase in Nasdaq’s quarterly dividend payment from $0.49$0.20 to $0.54$0.22 per share. |

·

| • | | Received regular reports on the M&A environment and Nasdaq’s pipeline of potential strategic transactions. |

· Reviewed and recommended, for Board approval, a debt refinancing transaction which reduced our annual interest expense.

·

| • | | Received an update on Nasdaq’s minority investment activities through the Nasdaq Ventures portfolio. |

| • | | Received updates on Nasdaq’s investor relations program. |

Risk Oversight Role: Risk Oversight Role:

·

| • | | Monitors operational and strategic risks related to Nasdaq’s financial affairs, including capital structure and liquidity risks. |

36

2024 | Nasdaq Proxy Statement | OUR BOARD

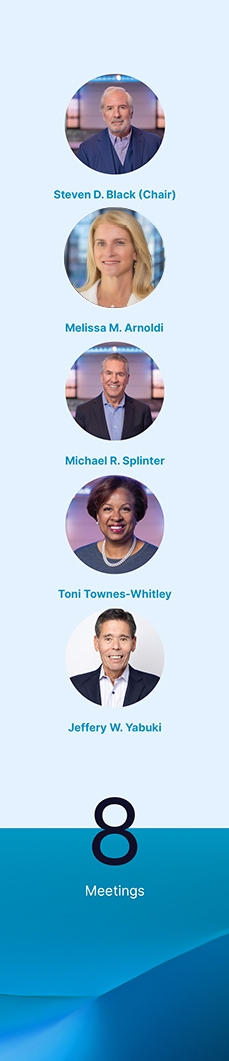

Management Compensation Committee Key Objectives: | • | |

|

| | |

| | Management Compensation Committee

Key Objectives:

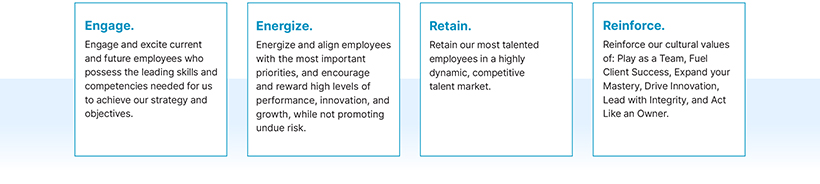

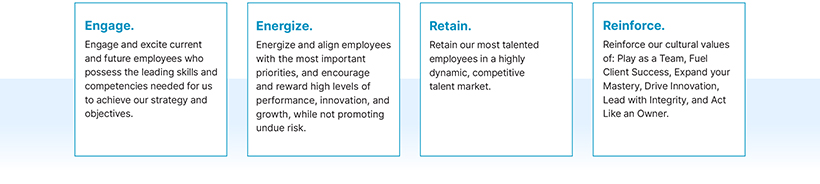

·Establishes and annually reviews the executive compensation philosophy and strategy.

|

·

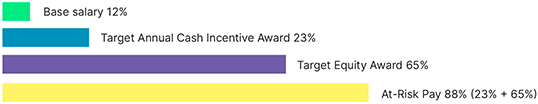

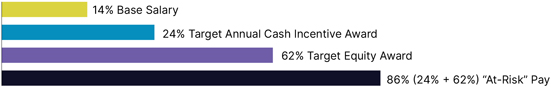

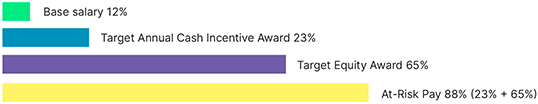

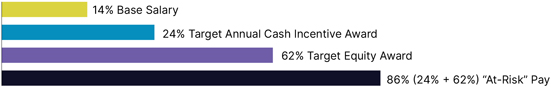

| • | | Reviews and approves the executive compensation and benefit programs applicable to Nasdaq’s executive officers, including the base salary, incentive compensation, and equity awards. Any executive compensation program changes solely applicable to the PresidentChair and CEO and CFO are submitted to the Board for final approval. |

·

| • | | Reviews and approves the performance goals for executive officers. For the PresidentChair and CEO, and CFO, these items are referred to the Board for final approval. |

·

| • | | Reviews and approves the basetarget total compensation (base salary andplus target bonus plus face value of long-term incentive compensationopportunities) for those non-executive officers officer new hires with target total cash compensation in excess of $1,000,000 or an$3,000,000 and equity awardawards to non-executive officers valued in excess of $1,000,000.$2,000,000. |

·

| • | | Evaluates the performance of the PresidentChair and CEO, together with the Nominating & ESG Committee. |

·

| • | | Reviews the succession and development plans for executive officers and other key talent. |

·

| • | | Establishes and annually monitors compliance with the mandatory stock ownership guidelines. |

·

| • | | Reviews the results of any shareholder advisory votes on executive compensation and any other feedback on executive compensation that may be garnered through the Company’s ongoing shareholder engagement. |

2023 Highlights: 2021 Highlights:

·

| • | | Reviewed negotiatedNasdaq’s evolving rewards program, including with respect to compensation program design and recommended Board approval of the new employment agreementat-risk percentage profile, in connection with Nasdaq’s President and CEO, Adena T. Friedman.ongoing transformation. |

· Provided feedback on

| • | | Reviewed Nasdaq’s pay equity analysis. |

·

| • | | Considered the effectiveness of the annual and long-term incentive plans to continue to support Nasdaq’s strategy and compensation structure. |

·

| • | | Reviewed the succession and development plans for all EVPs and SVPs.their direct reports. |

| • | | Reviewed and recommended Nasdaq’s revised incentive recoupment, or “clawback,” policy. |

| • | | Received briefings on regulatory developments, including the SEC rules and regulations regarding pay versus performance disclosure, Rule 10b5-1 plans, and clawback policies. |

| • | | Reviewed and recommended the termination of Nasdaq’s previously frozen pension plan following contributions from the Company of pension plan assets sufficient to settle its liabilities. |

Risk Oversight Role: Risk Oversight Role:

·

| • | | Evaluates the effect the compensation structure may have on risk-related decisions. |

Independence: Independence:

·

| • | | Each member of the Management Compensation Committee is independent and meets the additional eligibility requirements set forth in the listing rules of The Nasdaq Stock Market. |

2024 | Nasdaq Proxy Statement | OUR BOARD

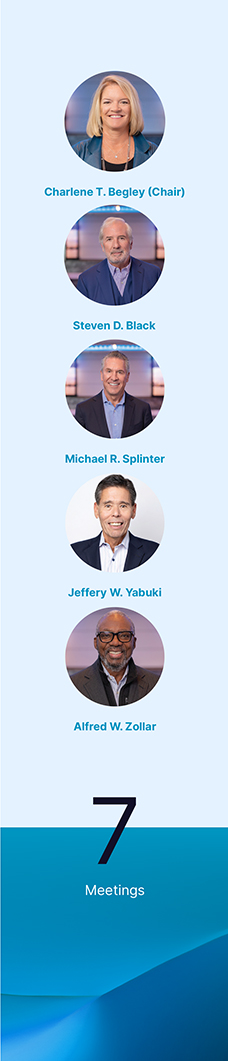

| | | Nominating & ESG Committee Key Objectives: Key Objectives:

·

| • | | Determines the skills and qualifications necessary for the Board, develops criteria for selecting potential directors, and manages the Board refreshment process. |

·

| • | | Identifies, reviews, evaluates, and nominates candidates for annual elections to the Board. |

·

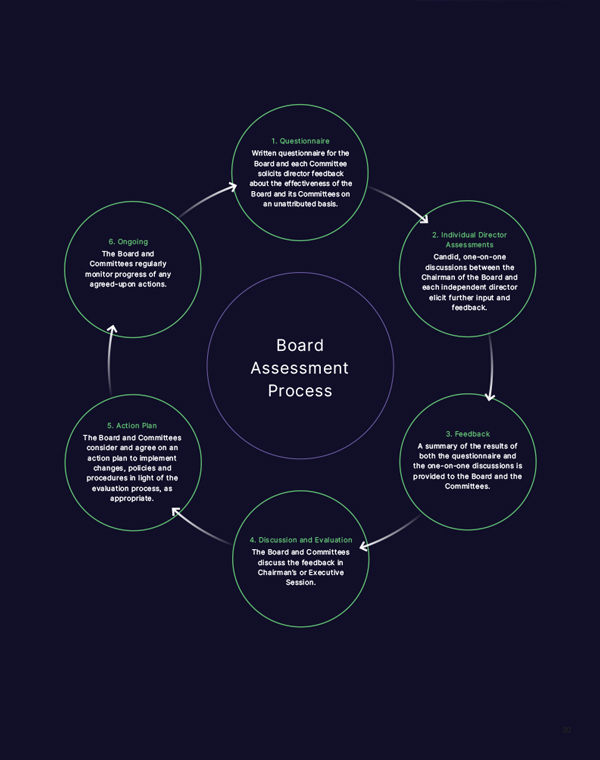

| • | | Leads the annual assessment of effectiveness of the Board, Committees, and individual directors. |

·

| • | | Together with the Management Compensation Committee, leads the annual performance assessment of the PresidentChair and CEO. |

·

| • | | Identifies and considers emerging corporate governance issues and trends. |

·

| • | | Reviews feedback from engagement sessions with investors and determines follow-up actions and plans. |

· Monitors Company compliance with corporate governance requirements and policies.

·

| • | | Reviews and recommends the Board and Committee membership and leadership structure. |

·

| • | | Reviews and recommends to the Nasdaq Board for election by the Board, candidates for election as officers withof Nasdaq that qualify as Section 16 officers and as “principal officers,” as that term is defined in the rank of EVP or above.Nasdaq By-Laws. |

·

| • | | Oversees environmental and social matters as they pertain to the Company’s business and long-term strategy and identifies and brings to the attention of the Board current and emerging environmental and social trends and issues that may affect the business operations, performance, and public image of Nasdaq. |

·

| • | | Provides oversight for Nasdaq’s environmental and social policies, practices, initiatives, and reporting, including those related to environmental sustainability, social and ethical issues, human capital management, responsible sourcing, and strengthening community.community involvement. |

| • | | Reviews and approves the annual Sustainability Report, the TCFD Report, and related Indexes. |

2023 Highlights: · Reviews

| • | | Focused on Nasdaq’s ongoing Board refreshment, including the Annual Sustainability Report.identification, assessment, and recommendation of three new directors, Jeffery W. Yabuki, Holden Spaht, and Kathryn A. Koch. |

2021 Highlights:

| • | | Considered shareholder feedback from engagement sessions, the 2023 Annual Meeting of Shareholders, and publicly available sources. |

·

| • | | Received tutorialsbriefings on ESG topics, includingsuch as Nasdaq’s ESG materiality assessment,culture evolution, governance trends, priorities for public company boards, and Nasdaq’s Purpose Initiative and Nasdaq’s Supplier Risk Management and Diversity Programs.Program. |

·

| • | | Monitored the achievement of Nasdaq’s corporate ESG goals. |

| • | | Received a climate-related director education briefing. |

Risk Oversight Role: · Focused on Nasdaq’s ongoing Board refreshment, including recommending and nominating Toni Townes-Whitley to the Board in September 2021.

· Considered shareholder feedback from engagement sessions, the 2021 Annual Meeting of Shareholders and publicly available sources.

Risk Oversight Role:

·

| • | | Oversees risks related to the Company’s ESG issues, trends, and policies. |

·

| • | | Monitors the independence of the Board. |

Independence: Independence:

·

| • | | Each member of the Nominating & ESG Committee is independent, as required by the listing rules of The Nasdaq Stock Market. | |

|

38

2024 | Nasdaq Proxy Statement | OUR BOARD

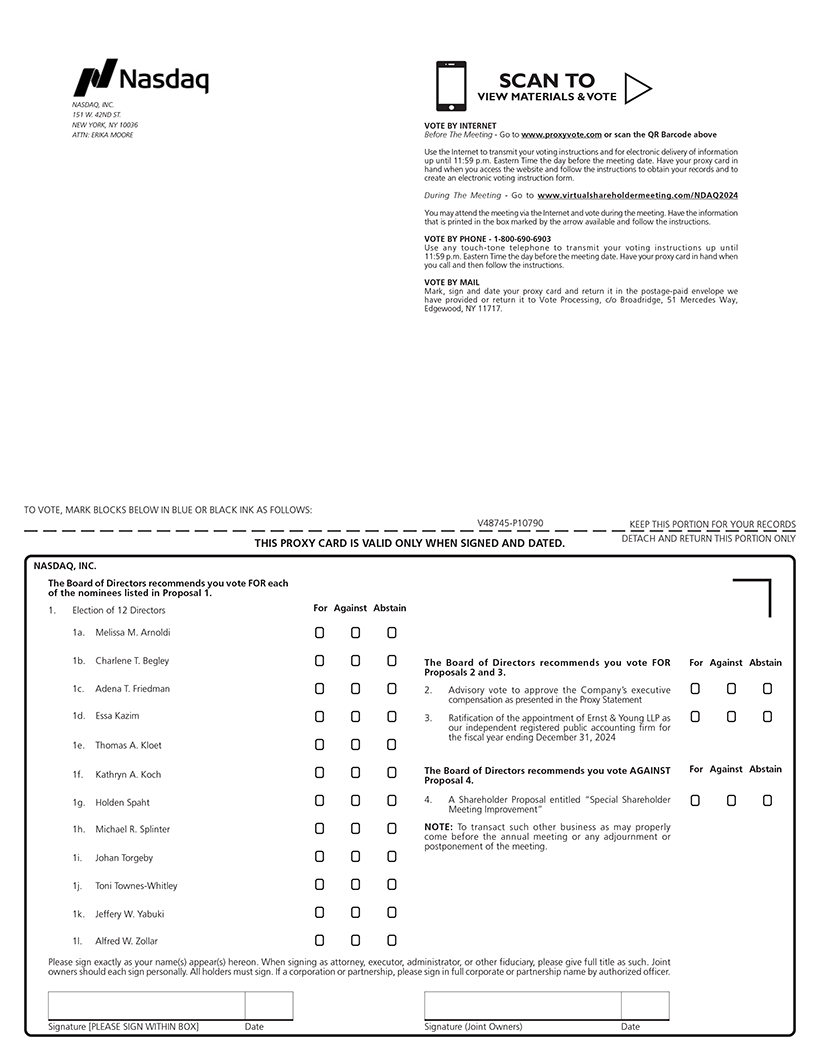

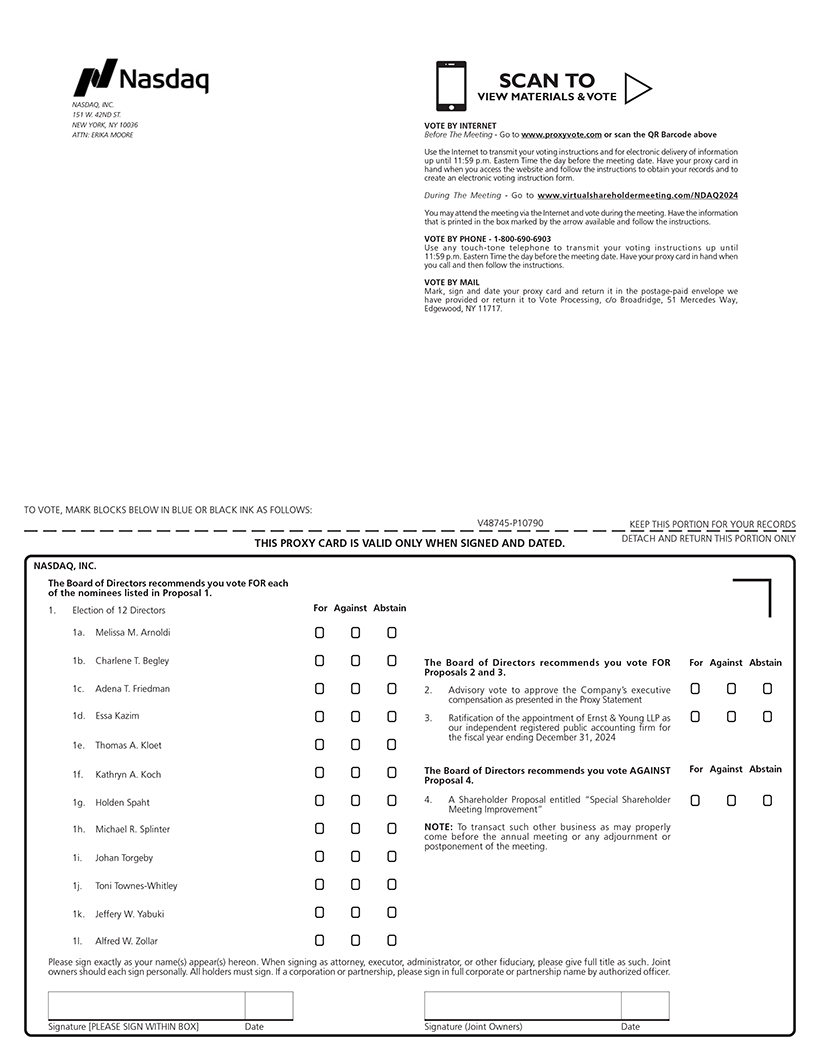

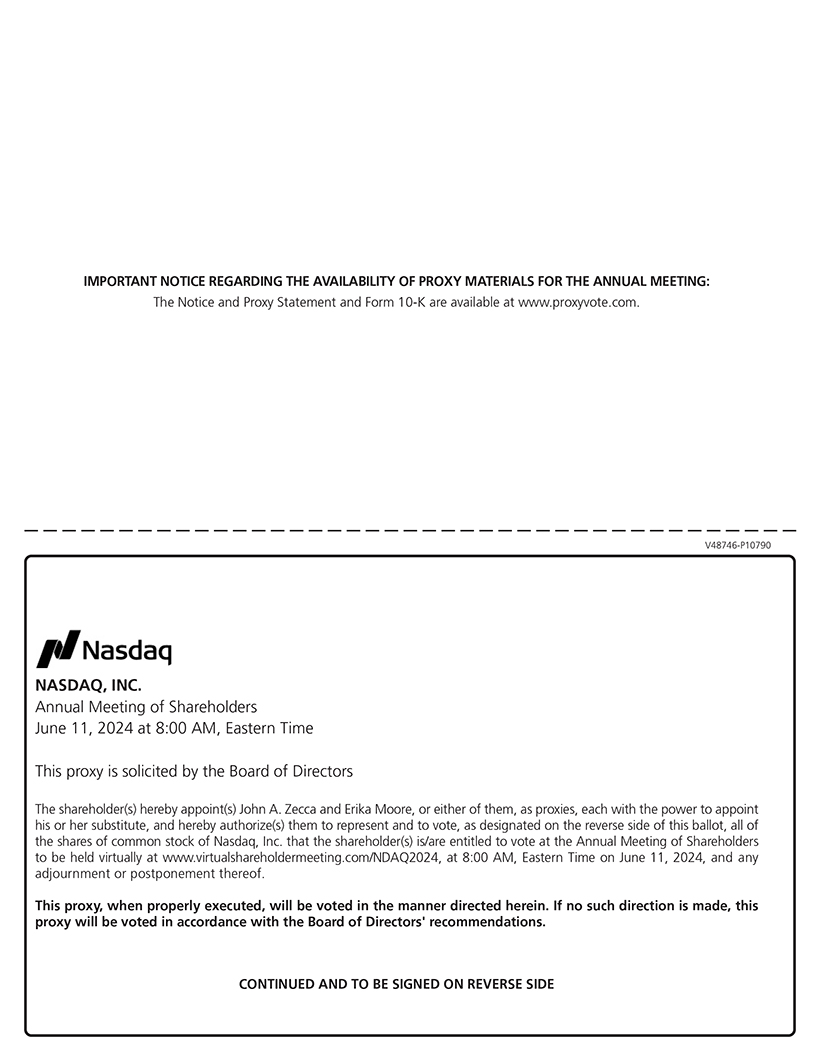

Director Compensation Our Board Compensation Policycompensation policy establishes the compensation of our non-employee directors. Every two years, the Management Compensation Committee reviews the Director Compensation Policy,director compensation policy, considers a competitive market analysis of director compensation data, and recommends changes, if any, to the policy to the Board for approval. The director compensation policy most recently was amended in June 2023, primarily to increase the annual retainer for Board Members by $10,000 to a total of $85,000. The other compensatory amounts set forth in the Board compensation policy were not changed pursuant to the June 2023 plan amendment. The following table reflects the compensation elements for non-employee directors for the current compensation year, which began immediately following the 20212023 Annual Meeting of Shareholders and ends with the 20222024 Annual Meeting. Our CEO, Ms. Friedman, does not receive any compensation for serving as Chair or as a director. Compensation Policy for Non-Employee Directors | | | | | | Item | | June 2021 - 2023- June 2022 2024 | | | Annual Retainer for Board Members (Other than the Chair) | | $75,00085,000 | | | Additional Annual Retainer for Board ChairLead Independent Director | | $240,00075,000 | | | Annual Equity Award for All Board Members (Grant Date Market Value) | | $260,000 | | | Annual Audit & Risk Committee Chair Compensation | | $40,000 | | | Annual Management Compensation Committee Chair Compensation | | $30,000 | | | Annual Finance and Nominating & ESG Committee Chair Compensation | | $20,000 | | | Annual Audit & Risk Committee Member Compensation | | $20,000 | | | Annual Management Compensation and Nominating & ESG Committee Member Compensation | | $10,000 | | | Annual Finance Committee Member Compensation | | $5,000 |

Each non-employee director may elect to receive the annual retainer in cash (payable in equal semi-annual installments) or equity. Each non-employee director also may elect to receive Committee Chair and/or Committee member fees in cash (payable in equal semi-annual installments) or equity. The annual equity award and any equity elected as part of the annual retainer or for Committee Chair and/or Committee member fees are awarded automatically on the date of the Annual Meeting of Shareholders immediately following election and appointment to the Board. All equity paid to Board members consists of RSUs that vest in full one year from the date of grant.grant date. The number of RSUs to be awarded is calculated based on the closing market price of our common stock on the date of the Annual Meeting. Directors that are appointed to the Board after the annual meetingAnnual Meeting receive a pro-rata equity award. Unvested equity is forfeited in certain circumstances upon termination of the director’s service on the Board. Directors are reimbursed for business expenses and reasonable travel expenses for attending Board and Committee meetings. Non-employee directors do not receive our retirement, health, or life insurance benefits. We provide each non-employee director with director and officer liability insurance coverage, as well as business accident travel insurance for and only when traveling on behalf of Nasdaq. 39

2024 | Nasdaq Proxy Statement | OUR BOARD

Stock Ownership Guidelines Under our stock ownership guidelines, the Chairman of the Board must maintain a minimum ownership level in Nasdaq common stock of six times the annual equity award for Board members. Other our non-employee directors must maintain a minimum ownership level of two times the annual equity award. Shares owned outright, through shared ownership, and in the form of vested and unvested restricted stock are taken into considerationconsidered in determining compliance with these stock ownership guidelines. Exceptions to this policy may be necessary or appropriate in individual situations, and the ChairmanChair of the Board may occasionally approve such exceptions from time to time.exceptions. New directors havemust obtain the minimum ownership level four years after their initial election to the Board to obtain the minimum ownership level.Board. All of the directors were in compliance with the guidelines as of December 31, 2021.2023. Director Compensation Table The table below summarizes the compensation paid by Nasdaq to our non-employee directors for services rendered during the fiscal year endedending December 31, 2021.2023. | | | | | | | | | | | | | | | | | | | | | | | | | | Name1 | | Fees Earned or Paid in Cash ($)2 | | Stock Awards ($)3,4,5 | | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) | | | | | | | | | Melissa M. Arnoldi | | — | | $ | 345,669 | | | — | | — | | — | | — | | $345,669 | | | | | | | | | Charlene T. Begley | | $115,000 | | $ | 256,812 | | | — | | — | | — | | — | | $371,812 | | | | | | | | | Steven D. Black | | — | | $ | 370,235 | | | — | | — | | — | | — | | $370,235 | | | | | | | | | Essa Kazim | | — | | $ | 335,738 | | | — | | — | | — | | — | | $335,738 | | | | | | | | | Thomas A. Kloet6 | | $155,000 | | $ | 370,235 | | | — | | — | | — | | $15,000 | | $540,235 | | | | | | | | | John D. Rainey | | — | | $ | 370,235 | | | — | | — | | — | | — | | $370,235 | | | | | | | | | Michael R. Splinter | | — | | $ | 513,625 | | | — | | — | | — | | — | | $513,625 | | | | | | | | | Toni Townes-Whitley | | $19,911 | | $ | 183,000 | | | — | | — | | — | | — | | $202,911 | | | | | | | | | Jacob Wallenberg | | — | | $ | 340,616 | | | — | | — | | — | | — | | $340,616 | | | | | | | | | Alfred W. Zollar | | — | | $ | 355,426 | | | — | | — | | — | | — | | $355,426 |

| | | | | | | | | | | Name1 | | Fees Earned or

Paid in Cash ($)2 | | Stock Awards

($)3,4,5 | | Total ($) | | | | | Melissa M. Arnoldi | | $87,500 | | $256,126 | | $343,626 | | | | | Charlene T. Begley | | $120,000 | | $256,126 | | $376,126 | | | | | Steven D. Black | | — | | $379,257 | | $379,257 | | | | | Essa Kazim | | — | | $344,738 | | $344,738 | | | | | Thomas A. Kloet6 | | $165,000 | | $379,257 | | $544,257 | | | | | John David Rainey7 | | — | | — | | — | | | | | Holden Spaht8 | | $12,295 | | $163,615 | | $175,910 | | | | | Michael R. Splinter | | — | | $423,539 | | $423,539 | | | | | Johan Torgeby | | $92,500 | | $256,126 | | $348,626 | | | | | Toni Townes-Whitley | | $110,000 | | $256,126 | | $366,126 | | | | | Jeffery W. Yabuki | | — | | $359,532 | | $359,532 | | | | | Alfred W. Zollar | | — | | $378,510 | | $378,510 |

1.(1) | Adena T. Friedman is not included in this table as she is an employee of Nasdaq and thus receivedreceives no compensation for her service as a director. For information on the compensation received by Ms. Friedman as an employee of the Company, see “Executive Compensation.” |

2.(2) | The differences in fees earned or paid in cash reported in this column largelyprimarily reflect differences in each individual director’s election to receive the annual retainer and Committee service fees in cash or in the form of RSUs. These elections are made at the beginning of the Board compensation year and apply throughout the year. In addition, the difference in fees earned or paid also reflects individual Committee service. |

3.(3) | The amounts reported in this column reflect the grant date fair value of the stock awards computed in accordance with FASB ASC Topic 718. The assumptions used in the calculation of these amounts are included in Note 11 to the Company’s audited financial statements for the fiscal year ended December 31, 20212023 included in our Form 10-K. The differences in the amounts reported among non-employee directors primarily reflect differences in each individual director’s election to receive the annual retainer and Committee service fees in cash or in the form of RSUs. |

4.(4) | These stock awards, which were awarded on June 15, 202121, 2023 to all the non-employee directors elected to the Board on that date, represent the annual equity award and any portion of annual retainer or Committee service fees that the director elected to receive in equity. Each non-employee director received the annual equity award, which consisted of 1,4745,142 RSUs with a grant date fair value of $256,812.$256,126. Mr. Splinter elected to receive his ChairmanLead Director retainer payment in equity so he received an additional 1,3612,966 RSUs with a grant date fair value of $237,125.$147,738. Directors Arnoldi, Black, Kazim, Kloet, Rainey, WallenbergYabuki, and Zollar elected to receive all of their annual retainers in equity, so they each re-ceivedreceived an additional 4251,681 RSUs with a grant date fair value of $74,047.$83,731. In addition, individual directors received the following amounts in equity, in lieu of cash, as payment for Committee service fees: Ms. Arnoldi (85Mr. Black (791 RSUs with a grant date fair value $14,809)$39,400); Mr. Black (226H.E. Kazim (98 RSUs with a grant date fair value of $39,376)$4,881); H.E. Kazim (28Mr. Kloet (791 RSUs with a grant date fair value of $4,878)$39,400); Mr. Kloet (226Splinter (395 RSUs with a grant date fair value of $39,376)$19,675); Mr. Rainey (226Yabuki (395 RSUs with a grant date fair value of $39,376)$19,675); and Mr. Splinter (113Zollar (776 RSUs with a grant date fair value of $19,688);$38,653). Mr. Wallenberg (56Zollar was also awarded 183 RSUs, which vested on the date of grant, as compensation for additional Board Committee service during the Board term ended June 21, 2023. Since he was appointed to the Board after the start of the compensation year, Mr. Spaht received a pro-rata annual equity award on November 27, 2023 of 3,001 RSUs with a grant date fair value of $9,757) and Mr. Zollar (141 RSUs with a$163,615. The grant date fair value of $24,566). On September 29, 2021, Ms. Townes-Whitley was appointed to the Board and received a pro-rata annual equity award of 951 RSUsawards reported in this footnote have been computed in accordance with a grant date fair value of $183,000.FASB ASC Topic 718. |

5.(5) | The aggregate numbers of unvested RSUs and vested shares granted under the Equity Plan and beneficially owned by each non-employee director as of December 31, 20212023 are summarized in the following table. All unvested RSUs willreported in the table are scheduled to vest on June 15, 2022.21, 2024. This table reflects shares acquired by the non-employee directors under the Equity Plan. For further information on each director’s Nasdaq holdings, please see “Security Ownership of Certain Beneficial Owners and Management.” |

40

2024 | Nasdaq Proxy Statement | OUR BOARD

| | | | | | | | | | | | Director | | Number of Unvested RSUs | | Number of Vested Shares | | | Melissa M. Arnoldi | | 1,984 | | 8,584 | Charlene T. Begley | | 1,474 | | 8,987 | Steven D. Black | | 2,125 | | 42,258 | Essa Kazim | | 1,927 | | 39,111 | Thomas A. Kloet | | 2,125 | | 20,778 | John D. Rainey | | 2,125 | | 12,765 | Michael R. Splinter | | 2,948 | | 62,923 | Toni Townes-Whitley | | 951 | | — | Jacob Wallenberg | | 1,955 | | 7,241 | Alfred W. Zollar | | 2,040 | | 6,551 |

| | | | | | | | Director | | Number of Unvested RSUs | | Number of Vested Shares | | | | Melissa M. Arnoldi | | 5,142 | | 37,071 | | | | Charlene T. Begley | | 5,142 | | 36,459 | | | | Steven D. Black | | 7,614 | | 140,469 | | | | Essa Kazim | | 6,921 | | 128,103 | | | | Thomas A. Kloet | | 7,614 | | 76,029 | | | | John David Rainey | | — | | 7,000 | | | | Holden Spaht | | 3,001 | | — | | | | Michael R. Splinter | | 8,503 | | 206,601 | | | | Johan Torgeby | | 5,142 | | 3,324 | | | | Toni Townes-Whitley | | 5,142 | | 7,929 | | | | Jeffery W. Yabuki | | 7,218 | | — | | | | Alfred W. Zollar | | 7,416 | | 32,982 |

6.(6) | Fees Earned or Paid in Cash to Mr. Kloet include fees of $155,000$165,000 for his service as ChairmanChair of the Boards of our U.S. exchange subsidiaries and their Regulatory Oversight Committees. Fees earned for Board and Committee service to our exchange subsidiaries are paid only in cash. Mr. Kloet directed all of the cash fees to a 501(c)(3) charity for this reporting year. All Other Compensation for Mr. Kloet represents fees for tax advisory services in connection with the compensation for service to our exchange subsidiaries. |

| | | Corporate Governance Framework

Our governance framework focuses on the interests of our shareholders. It is designed to promote governance transparency and ensure our Board has the necessary tools to review and evaluate our business operations and make decisions that are independent of management and in the best interests of our shareholders. Our goal is to align the interests of directors, management and shareholders while complying with, or exceeding, the requirements of The Nasdaq Stock Market and applicable law.

This governance framework establishes the practices our Board follows with respect to oversight of:

· our corporate strategy for long-term value creation;

· capital allocation;

· risk management, including risks relating to information security and the protection of our market systems;

· our human capital management program, corporate culture initiatives and ethics program;

· our corporate governance structures, principles and practices;

· Board refreshment and executive succession planning;

· executive compensation;

· corporate sustainability, including our ESG program and environmental and social initiatives; and

· compliance with local regulations and laws across our business lines and geographic regions.

| | Key Corporate Governance Documents

Nasdaq’s commitment to governance transparency is foundational to our business. This commitment is reflected in our governance documents listed below, which are all available online at ir.nasdaq.com.

· Corporate Governance Guidelines

· Board of Directors Duties & Obligations

· Code of Conduct for the Board of Directors

· Amended and Restated Certificate of Incorporation

· By-Laws

· Committee Charters

· Procedures for Communicating with the Board of Directors

|

| (7) | Mr. Rainey resigned from the Board effective as of February 28, 2023, and did not recieve any director compensation during 2023. |

| (8) | Fees earned by Mr. Spaht were paid to Thoma Bravo Advisors, L.P. |

41

Governance

2024 | Nasdaq Proxy Statement | GOVERNANCE

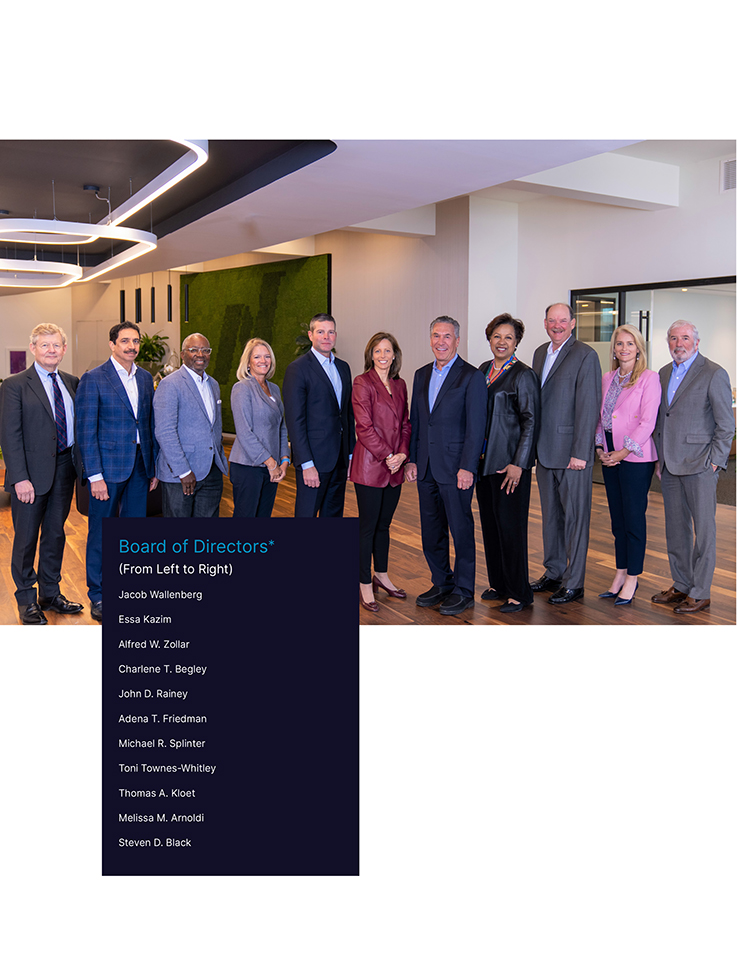

Governance Highlights We are committed to good corporate governance, which is a critical factor to help promote the long-term interests of our shareholders, strengthen our Board and management accountability, and build trust in the Company. Our governance highlights are summarized below, followed by more in-depth descriptions of the key aspects of our governance structure. The Board believes that its governance practices provide a structure that allows it to set objectives and monitor performance, ensure the efficient use of corporate resources, and enhance shareholder value. | | | Corporate Governance Practice HighlightsBoard Composition

and Processes | | • Continuous Board refreshment emphasizing diverse thought and experience Board Composition

All• 11 of 12 director nominees are independent except for our CEO

• Lead Independent Director with robust duties and oversight responsibilities • Independent Audit & Risk, Management Compensation, and Nominating & ESG Committees • Opportunity for Executive Session (without management present) at every Board and Committee meeting • Annual evaluations of the Board and each Committee, along with individual director self-assessments • Rigorous stock ownership guidelines, including at least 2x the annual equity award for each director •No director may serve on more than four public company boards (including the Nasdaq Board), without specific approval from the Audit & Risk Committee and Nominating & ESG Committee Philosophy of continuous Board refreshment to ensure a mix of skills, experience, tenure and diversity

Board Structure and Processes

Separation of the roles of Chairman of the Board and President and CEO of Nasdaq

Directors have the opportunity to meet in Executive Session without management present at every Board and Committee meeting

Three-tiered annual Board assessment, consisting of full Board evaluation, Committee evaluations and individual director assessments

•Ongoing Board review of strategic planning and capital allocation for long-term value creation for shareholders Nominating & ESG Committee oversight of environmental, social and human capital management policies, practices, initiatives and reporting

| | •Comprehensive risk oversight by the full Board under Audit & Risk Committee leadership Director stock ownership guidelines require equity ownership of at least 2x the annual equity award (for the Chairman, 6x)• Commitment to continuous learning and director education

Shareholder Rights• Board oversight of human capital management, including culture and DEI

• Independent Internal Audit Department under the leadership of a Chief Audit Executive who reports directly to the Audit & Risk Committee | | | | | | | Shareholder Rights | | • Robust, year-round shareholder engagement program •15% threshold for shareholders to call a special meeting •Proxy access allowing holders of 3% of our stock for three years to include up to two nominees (or nominees representing 25% of the Board) in our proxy •Annual election of directors, with majority voting in uncontested elections •No “poison pill” •Annual advisory vote on executive compensation Robust shareholder engagement program throughout the year

As of April 28, 2022• Shareholder communication process for communicating with our Board

|

43

2024 | Nasdaq Proxy Statement | GOVERNANCE

Corporate Governance Framework Our governance framework focuses on the interests of our shareholders. It is designed to promote governance transparency and ensure our Board has the necessary tools to review and evaluate our business operations and make decisions that are independent of management and in the best interests of our shareholders. Our goal is to align the interests of shareholders, directors, and management while complying with, or exceeding, the requirements of The Nasdaq Stock Market and applicable law. This governance framework establishes the practices our Board follows with respect to oversight of: | • | | our corporate strategy for long-term value creation; |

| • | | risk management, including risks relating to information security and the protection of our market systems; |

| • | | our human capital management program, corporate culture initiatives, and ethics program; |

| • | | our corporate governance structures, principles, and practices; |

| • | | Board refreshment and executive succession planning; |

| • | | corporate sustainability, including our ESG program and environmental and social initiatives; and |

| • | | compliance with local regulations and laws across our business lines and geographic regions. |

Key Corporate Governance Documents Nasdaq’s commitment to governance transparency is foundational to our business. This commitment is reflected in our governance documents listed below, which are all available online at ir.nasdaq.com. | • | | Amended and Restated Certificate of Incorporation |

| • | | Board of Directors Duties & Obligations |

| • | | Code of Conduct for the Board of Directors |

| • | | Corporate Governance Guidelines |

| • | | Procedures for Communicating with the Board of Directors |

44

2024 | Nasdaq Proxy Statement | GOVERNANCE

Board Leadership Structure Nasdaq’s governance framework provides the Board with the flexibility to select the appropriate leadership structure for the Board. In accordance withmaking determinations regarding the leadership structure, the Board considers the facts and circumstances at the time, including the specific needs of the business and a structure in the best interests of the Company and our Corporate Governance Guidelines, we separateshareholders. The Board is led by a Chair, who is elected annually by the roleBoard. The general duty of Chairmanthe Chair is to provide leadership on the Board, including setting Board and corporate culture, building consensus around Nasdaq’s strategy, and providing direction as to how the Board operates. The current leadership structure is comprised of a combined Chair and CEO, a Lead Independent Director, Board Committees led by independent directors, and active engagement by all directors. Eleven of 12 of our directors will be independent, assuming that all of the director nominees are elected at the 2024 Annual Meeting. Effective as of January 1, 2023, the independent members of the Board from the role of President and CEO. Our Board Chairman is an independent director. We believe that this separation of roles and allocation of distinct responsibilities to each role facilitates communication between senior management and the full Board about issues such as corporate governance, management development, succession planning, executive compensation, and the Company’s performance. Nasdaq’s President andunanimously elected our CEO, Adena T. Friedman, has over 25 years’ experience inas the securities industry. She is responsible forChair of the strategic direction, day-to-day leadership,Board, and performance of Nasdaq. The Chairman of Nasdaq’s Board,appointed Michael R. Splinter, bringsthe former Chair, as Lead Independent Director. The Board believes that having Ms. Friedman as the Chair and CEO allows the Company to convey our short-term and long-term strategy with a single voice to our shareholders, customers, regulators, and other stakeholders, particularly as we continue the realignment of our business and operations following the acquisition of Adenza in November 2023. Ms. Friedman’s leadership, deep understanding of our business gained by more than 30 years in the finance industry, knowledge of our operations, and broad role in the international financial ecosystem were all contributing factors to the Board’s decision to unify the Chair and CEO roles.

The Board recognizes that when the positions of Chair and CEO are combined, or when the Chair is not an independent director, it is imperative that the Board elect a strong Lead Independent Director with a clearly defined role and robust set of responsibilities. Simultaneously with the appointment of the Lead Independent Director, the Board amended the Company’s Corporate Governance Guidelines to provide additional, clearly defined duties for the Lead Independent Director, which are based on best practices. These duties are outlined in the following section. Mr. Splinter has complex, global technology business leadership experience, as a former public company CEO. governance expertise, and an extensive background in management development, compensation, and succession planning that the Board believes amplifies his role as Lead Independent Director. Each term of service in the Lead Independent Director position is one year. Our Board believes that our current structure, led by Ms. Friedman and Mr. Splinter, allows the Board to focus on significant strategic, governance, and operational issues; provides critical and effective leadership; and fosters a Board environment in which our independent directors can work together, provide oversight of our performance, and hold our management and senior leadership accountable, all of which we believe will benefit the long-term interests of our shareholders. | | Current Leadership Structure

|

45

2024 | Nasdaq Proxy Statement | GOVERNANCE

Duties and Responsibilities The Chairman provides guidanceduties and responsibilities of the Chair, CEO, and Lead Independent Director include, but are not limited to, the President and CEO, presides over Board meetings, including Executive Sessions, and serves as a primary liaison betweenitems described in the President and CEO and other directors.accompanying table below.

| | | | |

| | Chair | | CEO | | ✓ Presides at all meetings of the Board and shareholders ✓ Together with the Lead Independent Director, reviews and approves the meeting agendas and schedules to assure content and sufficient time for discussion of all agenda items ✓ Facilitates and encourages communication between management and the Board | | ✓ Supervises the business and affairs of the Company under the oversight of the Board ✓ Develops and executes our strategy against our short- and long-term objectives ✓ Builds and oversees the Management Committee | | | |

| | Lead Independent Director ✓ Presides at all meetings of the Board at which the Chair is not present ✓ Presides during Executive Sessions of the Board ✓ Calls meetings of the independent directors or the Board, as appropriate ✓ Facilitates discussion and open dialogue among the independent directors during Board meetings, Executive Sessions, and outside of Board meetings ✓ Briefs the Chair and CEO on issues discussed during Executive Sessions ✓ Serves as a liaison among the Chair and CEO and the other directors ✓ Together with the Chair and CEO, approves Board meeting agendas and schedules to assure content and sufficient time for discussion of all agenda items | | ✓ Authorizes the retention of advisors and consultants who report directly to the Board, when appropriate (Board Committees retain their own authority to engage advisors and consultants) ✓ Reviews and reports on the results of the Board and Committee assessments ✓ Discusses Board and Committee performance, effectiveness, and composition (including feedback from individual directors) with the Chair and CEO and meets individually with independent directors as needed ✓ Is available for consultation and direct communication with major investors and other stakeholders upon request |

46

2024 | Nasdaq Proxy Statement | GOVERNANCE

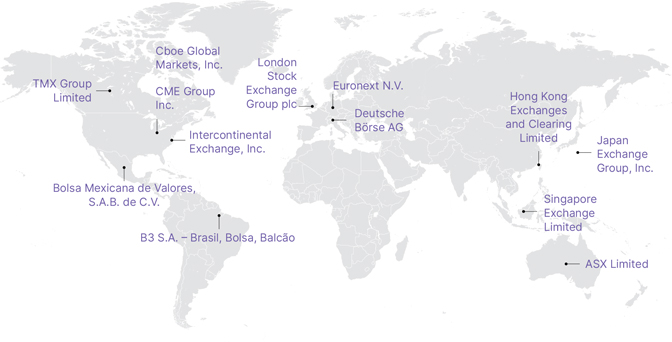

Board Independence Nasdaq’s common stock is currently listed on The Nasdaq Stock Market and Nasdaq Dubai. The listing rules of The Nasdaq Stock Market require a majority of our directors to be independent, while the Markets Rules of the Dubai Financial Services Authority require that at least one third of the Board should comprise non-executive directors, of which at least two non-executive directors should be independent. In order to qualify as independent under the listing rules of The Nasdaq Stock Market, a director must satisfy a two-part test. First, the director must not fall into any of several categories that would automatically disqualify the director from being deemed independent. Second, no director qualifies as independent unless the Board affirmatively determines that the director has no direct or indirect relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Under the Nasdaq Dubai listing rules and the Markets Rules of the Dubai Financial Services Authority, a director is considered independent if the Board determines the director to be independent in character and judgment and to have no commercial or other relationships or circumstances that are likely to affect, or could appear to impair, the director’s judgment in a manner other than in the best interests of the Company. NineNasdaq conducts an annual review of the independence of our tendirectors, and the Board has determined that 11 out of 12 of our current directors, as well as our newest director nomineesnominee, are independent underas defined by both the listing rules of Thethe Nasdaq Stock Market and Nasdaq Dubai.Dubai, as described above. As Nasdaq’s CEO, Ms. Friedman is deemed not to be independent because she is Nasdaq’s President and CEO.independent.

None of the director nomineescurrent or newly nominated directors are party to any arrangement with any person or entity other than the Company relating to compensation or other payments in connection with the director’s or nominee’s candidacy or service as a director, other than arrangements that existed prior to the director’s or nominee’s candidacy. The Board believes that a key element to effective, independent oversight is that the independent directors meet in Executive Session on a regular basisregularly without Company management present. As such, at each Board meeting, independent directors have the opportunity to meet in Executive Session. The independent ChairmanLead Independent Director of the Board is responsible for chairing the Executive Sessions of the Board and reporting to the PresidentChair and CEO and Corporate Secretary on any actions taken during Executive Sessions. In 2021,2023, the Board met teneight times in Executive Session. Additionally, the Board and each Committee hashave the authority and budget to retain independent advisors, if needed. Committee Independence and Expertise All Board Committees, except for the Finance Committee, are comprised exclusively of independent directors, as required by the listing rules of The Nasdaq Stock Market. At each Committee meeting, members of each Board Committee have the opportunity to meet in Executive Session. Each member of the Audit & Risk Committee is independent as defined in Exchange Act Rule 10A-3, adopted pursuant to the Sarbanes-Oxley Act of 2002, and in the listing rules of The Nasdaq Stock Market. Two members of the Audit & Risk Committee are “audit committee financial experts” within the meaning of SEC regulations and also meet the “financial sophistication” standard of The Nasdaq Stock Market.

47

2024 | Nasdaq Proxy Statement | GOVERNANCE

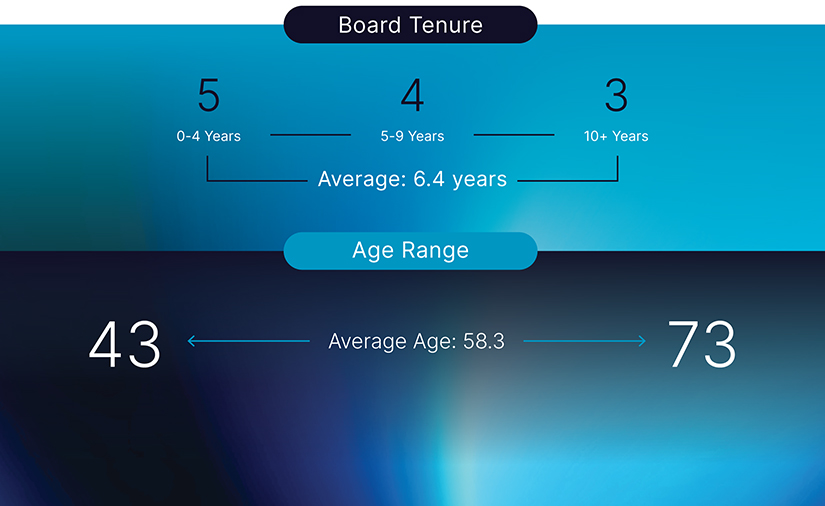

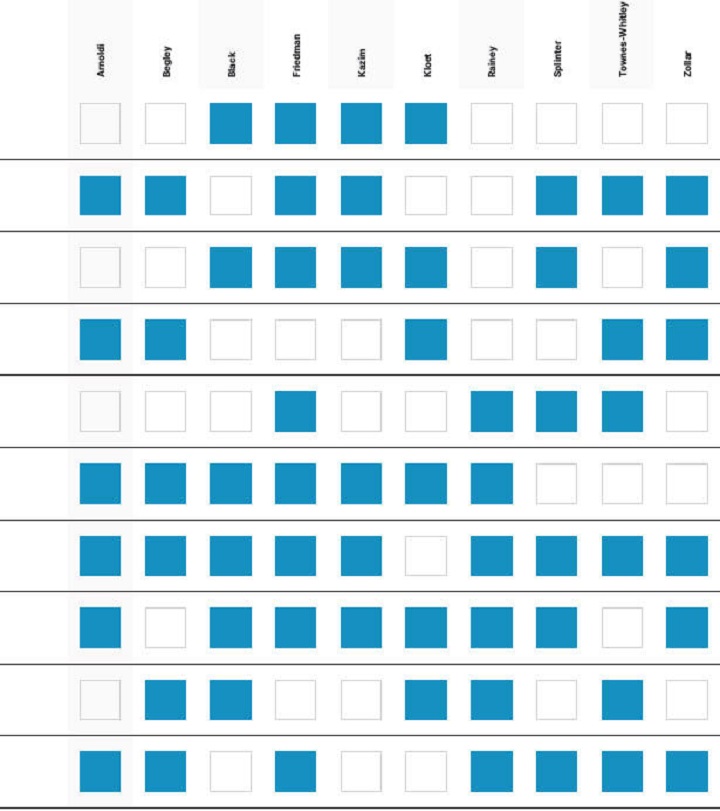

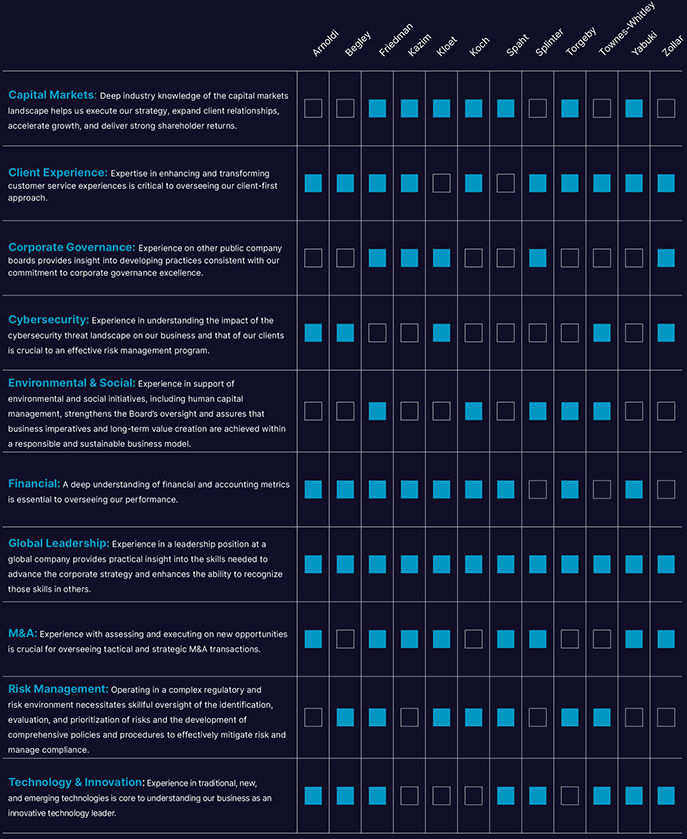

Board Diversity The Board values diversity in evaluating new candidates and seeks to incorporate a wide range of attributes across the Board of Directors and on each of our Committees. The following matrix is provided in accordance with applicable Nasdaq listing requirements and includes all directors as of April 26, 2024. For our prior year’s matrix, please see our 2023 Proxy Statement. Board Diversity Matrix (As of April 26, 2024) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total Number of Directors | | 12 | | | | | | | | | | | | Female | | | | | Male | | | | | Non-Binary | | | | | Did not

Disclose

Gender | | | | | | | | | Part I: Gender Identity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Directors | | | 4 | | | | | | | | 8 | | | | | | | | - | | | | | | | | - | | | | | | | | | | Part II: Demographic Background | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | African American or Black | | | 1 | | | | | | | | 1 | | | | | | | | - | | | | | | | | - | | | | | | | | | | Alaskan Native or Native American | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | | | Asian | | | - | | | | | | | | 1 | | | | | | | | - | | | | | | | | - | | | | | | | | | | Hispanic or Latinx | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | | | Native Hawaiian or Pacific Islander | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | | | White | | | 3 | | | | | | | | 6 | | | | | | | | - | | | | | | | | - | | | | | | | | | | Two or More Races or Ethnicities | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | | | LGBTQ+ | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | | | Did Not Disclose Demographic Background | | | - | | | | | | | | - | | | | | | | | - | | | | | | | | - | |

Service on Other Public Company Boards The Board recognizes that service on other public company boards provides Nasdaq directors with valuable experience that benefits the Company. At the same time, Nasdaq directors must be willing to devote sufficient time to carry out their duties and responsibilities effectively. As set forth in our Corporate Governance Guidelines, which are reviewed annually by the Nominating & ESG Committee and the Board, Nasdaq directors may serve on no more than four public company boards in addition to their Nasdaq Board service without specific approval from the Audit & Risk Committee and the Nominating & ESG Committee. The Nominating & ESG Committee evaluates compliance with this policy at least annually as part of the director nomination process. Service on other boards and/or committees of other organizations also should be consistent with Nasdaq’s conflict of interest policies. Directors may not serve on specific public company boards if prohibited by the Code of Conduct for the Board of Directors. Strategic Oversight The Board takes an active role with management to formulate and review our long-term corporate strategy and capital allocation plan for long-term value creation. The Board and management routinely confer on our execution of our long-term strategic plans, the status of key strategic initiatives, and the principal strategic opportunities and risks facing us. In addition, the Board periodically devotes meetings to conduct an in-depth long-term strategic review with our senior 48

2024 | Nasdaq Proxy Statement | GOVERNANCE

management team. During these reviews, the Board and management discuss emerging technological and macroeconomic trends and short and long-term plans and priorities for each of our business units.divisions. Additionally, the Board annually discusses and approves our budget and capital allocation plan, which are linked to our long-term strategic plans and priorities. Through these processes, the Board brings its collective, independent judgment to bear on the most critical long-term strategic issues facing Nasdaq. In 2021,2023, the Board received updates on Nasdaq’s corporate strategy at least quarterly, and often more frequently. The Board also held a multi-day strategy session during which it considered the next steps in our strategic pivot, reviewed plans for the Adenza integration, and discussed our strategic ambitionsthe competitive landscape, Nasdaq’s artificial intelligence and evaluated certainculture strategies, and the near-term strategic focus areas. The Board also reviewed and approved our acquisitions and divestitures in 2021, including Verafin and the sale of the U.S. portion of our Nasdaq Fixed Income business. priorities for each business division. For further information on our corporate strategy, see “Item 1. Business—Growth Strategy” in our Form 10-K. ESG

Beyond the Boardroom To increase each director’s engagement and full understanding of our strategy, each new director participates in an extensive onboarding program, which includes meeting with members of our executive leadership team to gain a deeper understanding of Nasdaq’s business and operations. Quarterly sessions are also provided to Board members on emerging topics and product demonstrations that help them be a strategic asset in the boardroom. See “Director Orientation and Continuing Education” for more information. Additionally, each director has the opportunity through our Investor Day presentations and other important stakeholder engagements to understand and assess how we communicate our strategy.

Sustainability Oversight Our Board is committed to overseeing Nasdaq’s integration of ESGsustainability principles and practices throughout the entire enterprise. Forty percent of our Board members have experience with environmental and social matters (including human capital management), which strengthens our Board’s review and oversight of our sustainability initiatives. The Nominating & ESG Committee has formal responsibility and oversight for ESG policies and programs and receives regular reporting on related key matters. Our internal Corporate ESG Steering Committee is co-chaired by executive leaders and is comprised of geographically diverse representatives from multiple business units.a cross-functional group of Nasdaq senior executives. The Corporate ESG Steering Committee serves as the central oversightcoordinating body for our environmental and socialESG strategy, and regularly reports that strategy to the Nominating & ESG Committee. The Corporate ESG Strategy and Reporting Team,team, which ultimately reports to the CFO, is responsible for execution of theour sustainability strategy,strategy; communicating our performance, metrics, and ambitions through our annual Corporate Sustainability Report, TCFD Report, and related ESG filings and surveys,disclosures; and collaborating with various stakeholders across the organization to ensure a timely and accurate data gathering process. Cybersecurity and Information Security Oversight Cybersecurity is an integral part of risk management at Nasdaq. The Board recognizes the rapidly evolving nature of threats presented by cybersecurity incidents and is committed to the prevention, timely detection, and mitigation of the effect any such incidents may have on us. We use a cross-departmental approach to assess and manage cybersecurity risk, with our Information Security, Legal, Risk and Regulatory, and Internal Audit functions presenting on key topics to the Audit & Risk Committee, which provides oversight of our cybersecurity risks. Our Global Risk Management Committee, which includes our Chair and CEO and other senior executives, assists the Audit & Risk Committee in its cybersecurity risk oversight role. Our Audit & Risk Committee receives quarterly or, if needed, more frequent reports as well as additional reports as needed, on cybersecurity and information security matters from our Chief Information Security Officer. A Cybersecurity Dashboard is presented each quarter which contains information on cybersecurity controls; incidentsOfficer and threats to the Company’s information security; and ongoing prevention and mitigation efforts for such threats. We routinely perform simulations and tabletop exercises, and incorporate external resources as needed, to help strengthen our cybersecurity protection and information security procedures and safeguards. All employees are required to complete an annual cybersecurity awareness training.

On an annual basis, the Information Security team reviews and updates its governance documents, including the Information Security Charter, the Information Security Policy and the Information Security Program Plan, and then presents the revised documentshis team. This regular reporting to the Audit & Risk Committee for review and/includes a cybersecurity dashboard that contains information on cybersecurity controls and from time to time also includes information on projects to strengthen internal cybersecurity, ongoing prevention and mitigation efforts, security features of the products and services we provide our customers, or approval. Additionally,security events during 2021, the Information Security team continued to execute onperiod. The Audit & Risk Committee also reviews and discusses recent cyber incidents affecting our industry and the Cybersecurity Strategic Plan, which outlines the strategic vision and associated goals for the cybersecurity of Nasdaq’s global operations for the three-year period from 2020 through the end of 2022.emerging threat landscape.

Finally, the Information Security team engaged Ernst & Young LLP in 2020We periodically engage external advisors to perform an analysis of Nasdaq’sour information security procedures. During 2022, Ernst & Young LLP will againprocedures, which includes a review of program documentation and conduct an overall maturity assessment of Nasdaq’s information security programs, and theprograms. These advisors provide recommendations to further enhance our procedures. The findings will beare then presented to the Audit & Risk Committee.Committee of the Board of Directors. Our management team and the Audit & Risk Committee have conducted tabletop exercises and simulations in cybersecurity matters with assistance from internal and outside experts.

49

2024 | Nasdaq Proxy Statement | GOVERNANCE

For further information regarding our cybersecurity risk management strategy and governance practices, please see “Item 1.C - Cybersecurity” in our Form 10-K. Data Privacy PrivacyData privacy is integralvital to our business and Nasdaq iswe are committed to the protection of the personal data which it processesthat we process as part of itsour business and on behalf of our customers. We understand the trust our customers, employees, and members of the public place in us when they share their personal information and to that end, we have established a robust global privacy program with oversight by executive management, an independent Data Protection Officer for our European regulated entities, and at the Board level, our Audit & Risk Committee. Our governance and accountability measures promote core principles of data privacy, while the collaborative effort between our Information Security Team and Legal, Risk and Regulatory Group enables us to meet our regulatory requirements and demonstrate compliance.

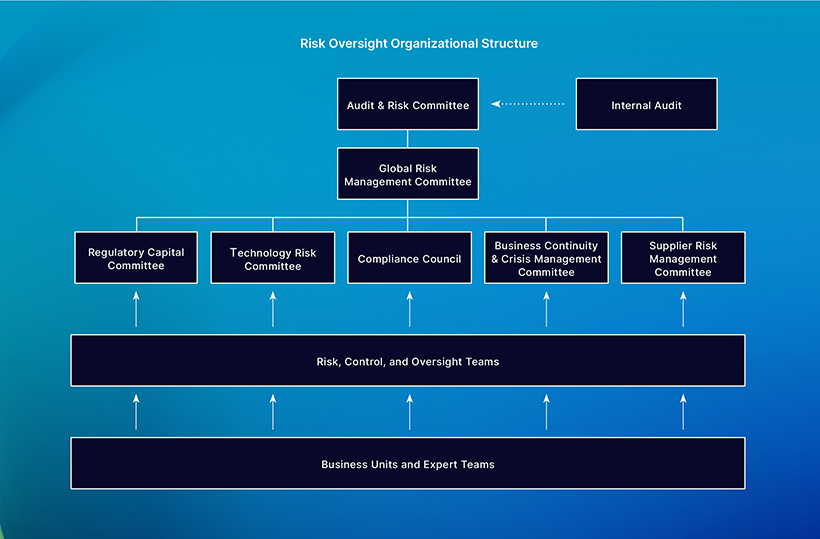

Risk Oversight The Board’s role in risk oversight is consistent with our leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure, and the Board having ultimate responsibility for overseeing risk management with a focus on the most significant risks facing the Company. The Board is assisted in meeting this responsibility by several Board Committees as described under “Our Board — Board Committees.” The Audit & Risk Committee receives regular reports relating to operational compliance with the Company’s risk appetite and reviews any deviations, ultimately reporting on them to the Board.deviations. The Board, through the Audit & Risk Committee, approves the Company’s risk appetite, which is the boundaries within which our management operates while achieving corporate objectives. In addition, the Board reviews and approves the Company’s ERM Policy, which mandates ERM requirements and defines employees’ risk management roles and responsibilities. Under ourthe ERM Policy, we employ an ERM approach that manages risk through objective and consistent identification, assessment, monitoring, and measurement of significant risks across the Company. We classify risks into the following five broad categories. ·• | | Strategic and Business Risk: Risk to earnings and capital arising from changes in the business environment and from adverse business decisions, improper implementation of decisions, or lack of responsiveness to changes in the business environment. |

·• | | Financial Risk:Risk to our financial position or ability to operate due to investment decisions and financial risk management practices, in particular as it relates to market, credit, capital, and liquidity risks. |

·• | | Operational Risk:Risks arising from our people, processes, and systems and from external causes, including, among other things, risks related to transaction errors, financial misstatements, technology, information security (including cybersecurity), engagement of third parties, and maintaining business continuity. |

·• | | Legal and Regulatory Risk:Exposure Risks related to data privacy, intellectual property, financial crime, and employment law, among other areas, as well as risks of exposure to civil and criminal consequences — includingwhile conducting our business operations, such as regulatory penalties, fines, forfeiture, and litigation — while conducting our business operations.and/or litigation. |

·• | | ESG Risk:Risks arising from perceived or actual shortcomings in the management of ESGsustainability matters. |

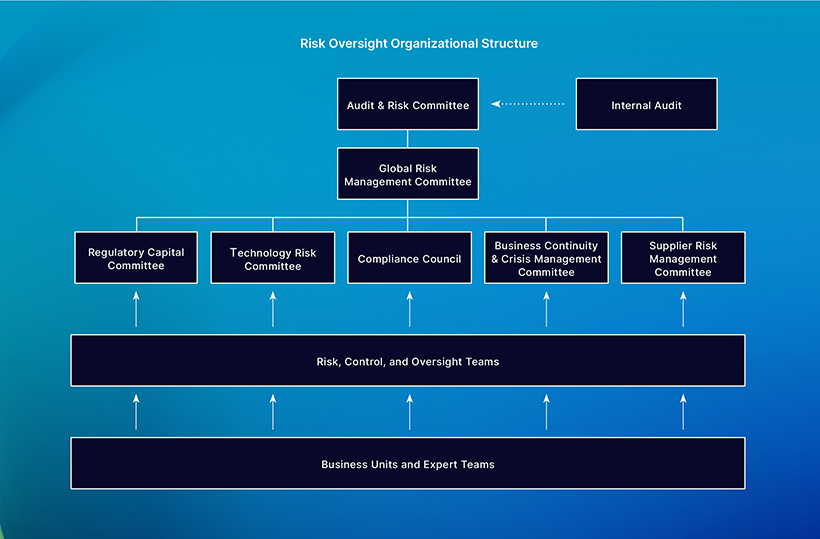

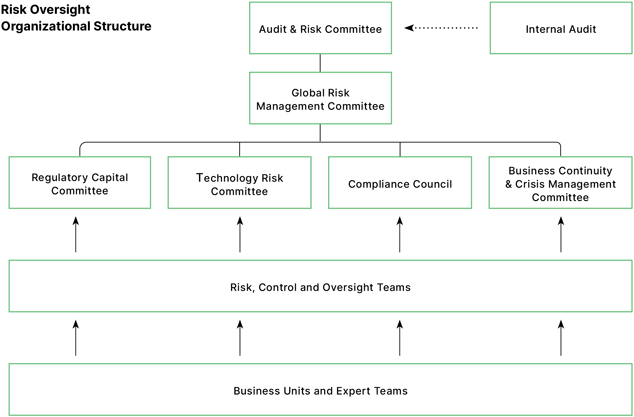

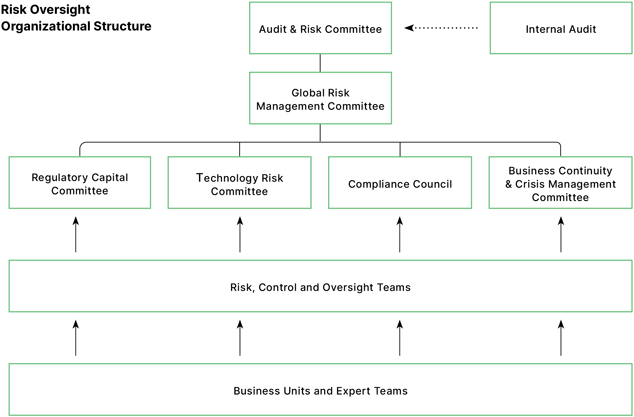

Our management has day-to-day responsibility for:for managing risk arising from our activities, including making decisions within stated Board-delegated authority; ensuring employees understand their responsibilities for managing risk through a “three lines model of risk management” model;management;” and establishing internal controls as well as guidance and standards to implement the risk management policy.ERM Policy. In the “three lines model of risk management” model,management,” the first line, consisting of the business units and expert teams (i.e., corporate 50

2024 | Nasdaq Proxy Statement | GOVERNANCE

support units), executes core processes and controls. The second line, consisting of the risk, control, and oversight teams, sets policies and establishes frameworks to manage risks. The third line, which is the Internal Audit Department, provides an independent review of the first and second lines. Our Global Risk Management Committee, which includes our PresidentChair and CEO and other senior executives, assists the Board in its risk oversight role, ensuring that the ERM framework is appropriate and functioning as intended and the level of risk assumed by the Company is consistent with Nasdaq’s strategy and risk appetite. We also have other limited-scope risk management risk committees that address specific risks, geographic areas, and/or subsidiaries. These risk management committees, which include representatives from business unitsdivisions and expert teams, monitor current and emerging risks within their purview to ensure an appropriate level of risk. Together, the various risk management risk committees facilitate timely escalation of issues to the Global Risk Management Committee, which escalates critical issues to the Board. These risk management committees include the following:following. · | • | | The Compliance Council identifies, monitors, and addresses regulatory and corporate compliance risks. | |

· | • | | The Global Technology Risk Committee oversees technology risks within our strategic products and applications. | |

· | • | | The Business Continuity and& Crisis Management Committee oversees business continuity and resiliency related risks. | |

· | • | | The Regulatory Capital Committee oversees the global regulatory capital framework for our regulated entities and the level of regulatory capital risk. | |

| • | | The Supplier Risk Management Committee oversees third party risks related to suppliers. | |

Nasdaq’s Group Risk Management Department, which is part of the Legal, Risk and Regulatory Group, oversees the ERM framework, supports its implementation, and aggregates and reports risk information.

2024 | Nasdaq Proxy Statement | GOVERNANCE

Human Capital Management Oversight and Executive Succession Planning Our Board believes that human capital management oversight and executive succession planning are some ofamong its most critical duties. The Board regularly receives updates on Nasdaq’s culture and people-related initiatives. In 2021,2023, topics discussed included: our Diversity, Equity and Culture initiatives;an organizational health dashboard; our employee engagement survey results; Nasdaq’s return-to-officeour DEI initiatives; our talent development and well-being programs; our return-to-office and future-of-work initiatives; employee retention efforts in lightand culture implications of the tight labor market; and Nasdaq’s employer brand messaging and employee value proposition.Adenza acquisition. Both formally on an annual basis and informally throughout the year in Executive Session, the Nominating & ESG Committee, the Management Compensation Committee, the Board, and the PresidentChair and CEO review the succession planning and leadership development program. This includes a short-term and long-term succession plan for development, retentiondeveloping, retaining, and replacement ofreplacing senior officers. These reviews and succession planning discussions take into account desired leadership skills, key capabilities, and experience in light of our current and evolving business and strategic direction. Our directors also have exposure to potential internal succession candidates through Board and Committee presentations and discussions, as well as informal events and interactions throughout the year. In conjunction with the annual report of the succession plan, the President and CEO also reports on Nasdaq’s program for senior management leadership development.

In addition, the PresidentChair and CEO prepares, and the Board reviews, a short-term succession plan that delineates a temporary delegation of authority to certain officers of the Company, if some or all of the senior officers should unexpectedly become unable to perform their duties. The Board also has implemented its own short-term succession plan in the event any of the Directors becamedirectors become temporarily incapacitated or unable to act. Finally, following our annual executive succession planning exercise with our Board, we achievedwitnessed a 32% year-over-year3% increase in 2023, as compared to 2022, in the diversity of our senior executive succession candidates (considering gender, race, and LGBTQ+ status) in 2021 due to a focus by our senior executives on identifying and cultivating talent deeper in their organizations. Board Meetings and Attendance The Board held 11 meetings during the 20212023 fiscal year, and the Board met in Executive Session without management present during 10eight of those meetings. At each Board or Committee meeting, a quorum consists of a majority of the Board or Committee members. The Board expects its members willto meticulously prepare for, join, and participate in all Board and applicable committeeCommittee meetings and each Annual Meeting. Each of the incumbent directors who served for the full year of 20212023 attended at least 92%88% of the meetings of the Board and those Committees on which the director served. Ms. Townes-Whitley joined the Board effective September 29, 2021. Following that date, she attended two of three meetings of the Audit & Risk Committee and three of four meetings of the Board, resulting in 71% attendance. Her absences from these meetings were due solely to the illness and sudden death of a close family member.

In addition to participation at Board and committeeCommittee meetings, our directors frequently have frequent individual meetings and other communications with our Chairman, ourChair and CEO, Lead Independent Director, and other members of the leadership team. Directors are also encouraged to attend our annual meetingAnnual Meeting of shareholders.Shareholders. All of the current members of the Board who were directors at the time of the Annual Meeting held on June 15, 202121, 2023 attended the Annual Meeting. Shareholder Rights Nasdaq does not have a classified Board. All directors are elected annually. We also have a majority vote standard for uncontested director elections. We implementedOur proxy access by amending our By-Laws to allowright allows a shareholder, or group of shareholders, that owns at least 3% of our outstanding common stock for three years and complies with certain customary requirements, to nominate candidates for service on the Board and have those candidates included in Nasdaq’s proxy materials. Candidates nominated pursuant to this provision may constitute up to the greater of two individuals or 25% of the total number of directors then in office for a particular annual meetingAnnual Meeting of shareholders.Shareholders.

52

2024 | Nasdaq Proxy Statement | GOVERNANCE

Shareholders representing 15% or more of outstanding shares for one year can convene a special meeting of Nasdaq’s shareholders. For more on our proactive outreach efforts with our shareholders, see “Shareholder Engagement” on page 8.Engagement.” Public Policy Advocacy for Investors, Capital Formation and Inclusive Capitalism As part of our duty to shareholders, employees, and the markets, Nasdaq actively participates in public policy debates in Europe, the United States, Europe, and elsewhere. Nasdaq maintains a vigorous global employee education program with respect to the Foreign Corrupt Practices Act and other jurisdictional prohibitions on pay-for-play. Nasdaq does not support any political campaigns, or so-called “Super PACs,” directly with Nasdaq funds. In the United States, Nasdaq has the responsibility to use its voice to educate policymakers and advocate forregulators. Nasdaq’s advocacy focuses on policies affecting the capital markets. Nasdaq concentrates its efforts on education and outreach and utilizes a modest Political Action Committee, or PAC, program, known as the Nasdaq PAC. The Nasdaq PAC is funded entirely through voluntary employee contributions and supports only federal Congressional campaigns. Nasdaq’s PAC is governed by a board of employees who vote on every disbursement. With respect to our European operations, we focus our advocacy programs on active education and engagement with elected leaders and key policymakers. Our policies in Europe follow prevailing jurisdictional law and preclude any monetary contributions to political parties, candidates, or their designees. Nasdaq maintains memberships in a number ofmultiple associations around the globe that serve as important partners for our industry, clients, and employees including the World Federation of Exchanges, Federation of European StockSecurities Exchanges, U.S. Securities Markets Coalition, Equity Markets Association, Partnership for New York City, Business RoundTable, Silicon Valley Leadership Group,Roundtable, European Association of Clearing Houses, U.S. Chamber of Commerce, TechNet, and others. The actions described above constitute a long-standing practice and risk mitigation policy. Communicating with the Board Shareholders and other interested parties may contact the Board, the Chair and CEO, the Lead Independent Director, or other individual directors by writing us at AskBoard@nasdaq.com or c/o Erika Moore, VP, Deputy General Counsel and Corporate Secretary, 805 King Farm Boulevard, Rockville, Maryland 20850. Complaints or Ethical Concerns? We have also established mechanisms for receiving, retaining, and addressing ethics and compliance concerns or allegations of misconduct through our SpeakUp! Program. Employees, contractors, and third parties doing business with Nasdaq have multiple channels for raising ethics concerns in a highly confidential and/or anonymous manner. Nasdaq does not tolerate retaliation against anyone who reports potential misconduct regardless of the reporting channel used. For more on our Code of Ethics, see page 62 or visit ir.nasdaq.com. | | |  | | 53 Communicating with the Board

Shareholders and other interested parties may contact the Board, the Chairman or other individual Directors by writing us at AskBoard@nasdaq.com or c/o Erika Moore, VP, Deputy General Counsel and Corporate Secretary, 805 King Farm Boulevard, Rockville, Maryland 20850.

Complaints or Ethical Concerns?

We have also established mechanisms for receiving, retaining, and addressing ethics and compliance concerns or allegations of misconduct through our SpeakUp! Program. Employees, contractors and third parties doing business with Nasdaq have multiple channels for raising ethics concerns in a highly confidential and/or anonymous manner. Nasdaq does not tolerate retaliation against anyone who reports potential misconduct regardless of the reporting channel used.

For more on our Code of Ethics, see page 57 or visit ir.nasdaq.com.

| |

|

|

|

Corporate Sustainability

54

2024 | Nasdaq Proxy Statement | CORPORATE SUSTAINABILITY

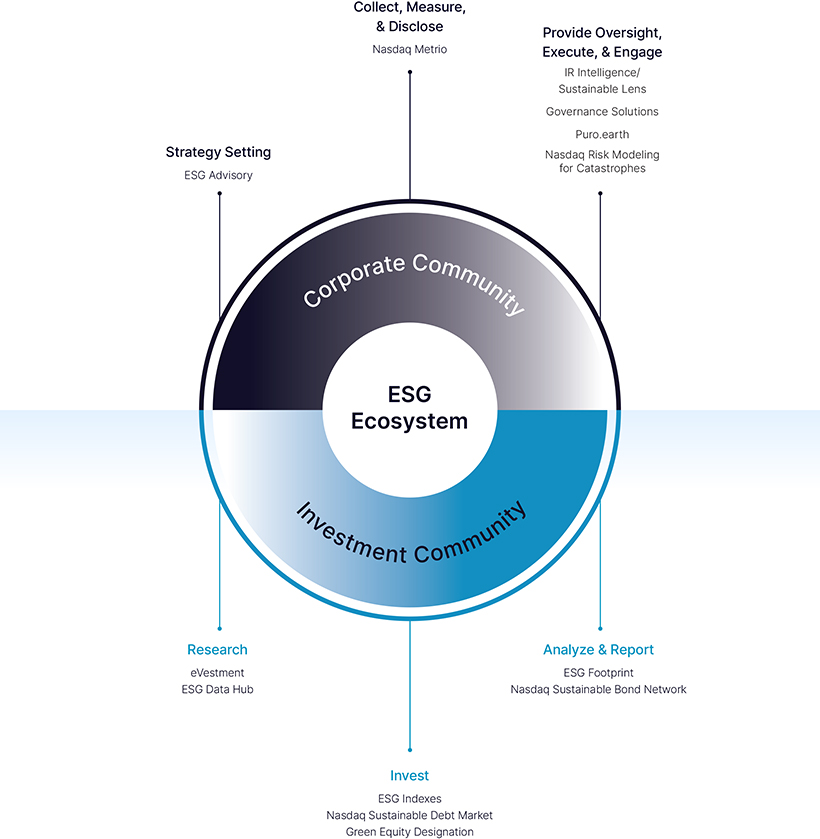

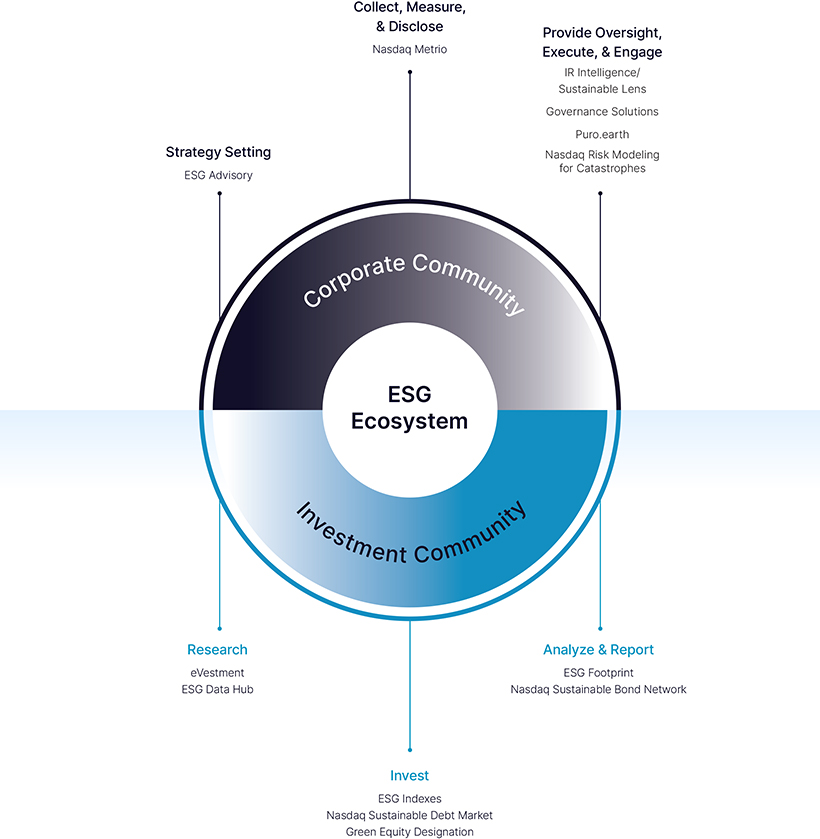

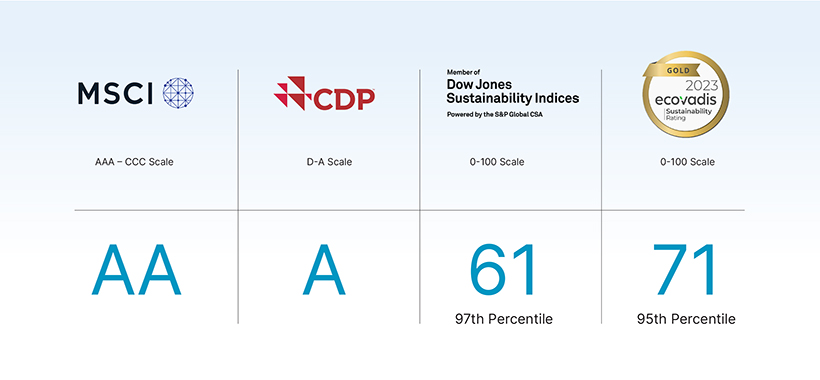

At Nasdaq, our purpose is to advance economic progress for all. We strive not only to become the trusted fabric of the world’s financial system, but also to power stronger economies, create more equitable opportunities, build a more inclusive capital markets ecosystem, and contribute to a more sustainable world. Our ESG Strategy Atcommitment to leadership in sustainability principles and practices is integrated across our operations, enhancing our competitiveness, resilience, and relationships with our stakeholders. As a financial technology company at the epicenter of capital markets and technology, we are uniquely positioned to lead the acceleration of ESG excellence in sustainability both in respect of how we operate internally and by empowering our communitiesclients with strategic solutions intended to have a meaningful and sustainable impact.

Our corporate sustainability strategy is designed to solidify our business resilience. We are committed to advancing meaningful sustainability efforts to reverse the negative effects of climate change by minimizing our environmental footprint and delivering market-based innovations that have measurablesupport a net-zero future. We also intend to deepen our culture of diversity, equity, and lasting impact.inclusion as we solidify our position as a destination for the world’s leading talent, and to continue to lead with robust governance policies.

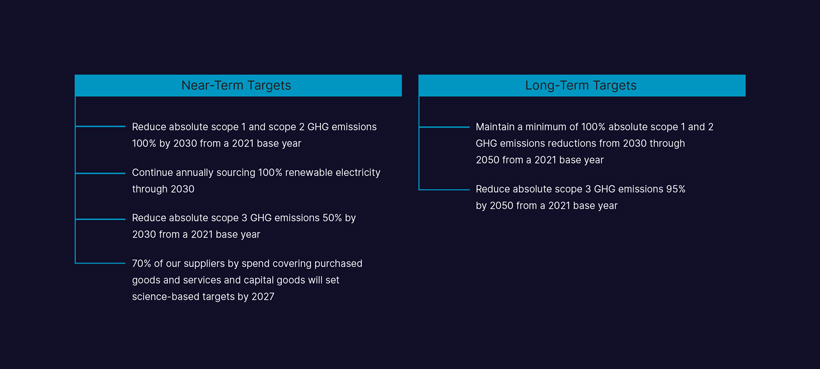

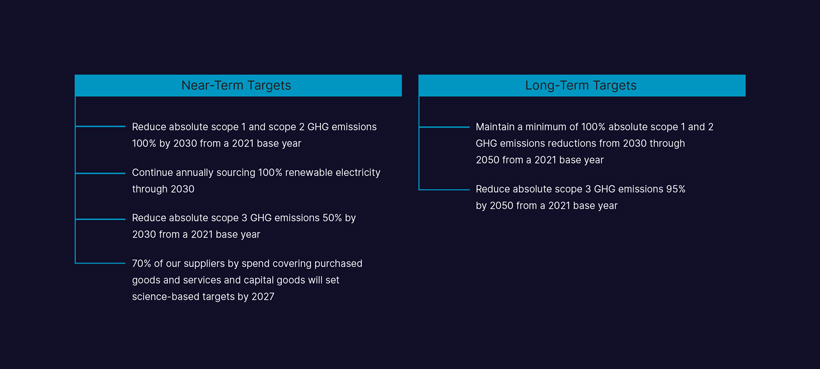

Environmental Initiatives Nasdaq is committed to environmentally friendly business practices and will continue to pursue activities that underscore our commitment to the key environmental initiatives described below. Optimizing Our Real EstateFootprint To ensure the sustainability of our real estate portfolio, we aspire to increase the number of green certifications for our office space design, construction, and Facilities Footprint, Improvingoperations. In 2023, we achieved three additional LEED Gold certifications, which increased our certifications to 16 and increased the Accessibilitypercentage of our portfolio that is green certified to 59%. Our OfficesEnvironmental Practices Statement and Environmental Management System Policy emphasize our commitment to act as a responsible corporate citizen, endeavoring to lessen our environmental impact and make our operations environmentally efficient. We are continuing to utilize our Environmental Management System for our real estate and data center portfolios to ensure that environmental opportunities and risks are considered as we make strategic decisions. We also completed our third TCFD report on our global office and data center locations. The report outlines our climate-related risks and opportunities, the Preservationassociated impact on our business, our management strategy to address these risks, and related metrics and targets to further address climate risks. Reducing Our Environmental Impact Our climate strategy is guided by our two environmental programs: our carbon net-zero program and our carbon neutrality program. Our carbon net-zero program is driven by initiatives to reduce our GHG emissions across Nasdaq’s business operations and supply chain, while the focus of Natural Resourcesour carbon neutrality program is on procuring 100% renewable electricity and high-quality carbon offsets. In 2023, we continued our carbon neutrality program for the sixth consecutive year, and expect to retire our remaining carbon offsets for 2023 by the third quarter of 2024. We plan to expand our carbon neutrality program to include Adenza as we continue our integration efforts. Nasdaq’s near- and long-term science-based emissions reduction targets were approved by the Science Based Targets initiative, or SBTi. The SBTi has verified our long-term, 2050 net-zero science-based target. We have committed to achieving the validated targets described on the next page. · | | We aspire to achieve a Green Certification for all new office construction. Our new Nasdaq headquarters in New York City achieved a Green Building LEED Platinum Certification in 2021 and we are working to add eight new LEED certified locations to our office portfolio in 2022. |

· | | In 2021, we continued our net carbon neutral program for the fourth consecutive year. The key focuses of the program are to: |

| ¾ | | reduce the energy consumption, corresponding greenhouse gas emissions and waste generation of our global operations through thoughtful sustainable initiatives and strategies. |

| ¾ | | proactively procure renewable energy for our office space and data center portfolio. |

| ¾ | | purchase Renewable Energy Certificates from projects that are less than five years old and feed power into the same energy distribution network as our operations to replace any fossil fuel electricity power consumed (indirectly removing the release of Greenhouse gases from the atmosphere). |

| ¾ | | purchase credible Carbon Offsets from projects that focus entirely on carbon removal to neutralize the associated greenhouse gas emissions related to our Scope 1 and Scope 3 categories (indirectly removing the release of Greenhouse gases from the atmosphere). |

| ¾ | | engage a third party to verify and certify our carbon footprint data for accuracy and industry best practices. |

· | | We signed the Science Based Targets initiative commitment letter in 2021 and this year we will submit our net zero short-term and long-term targets for our Scope 1, Scope 2 and material Scope 3 emission categories. |

2024 | Nasdaq Proxy Statement | CORPORATE SUSTAINABILITY · | | In 2021, we audited and benchmarked our recycling programs in all global offices and implemented a strategy to raise our minimum standard. |

· | | When possible, our offices are located near public transportation or electric car charging stations. |

· | | In many locations, we have a longstanding practice of offering employees pre-tax public transportation passes, allowances or subsidies. |

· | | Our Environmental Practices Statement and Environmental Management System Policy emphasize our commitment to act as a responsible corporate citizen, endeavoring to lessen our environmental impact and make our operations environmentally efficient. |

· | | In 2022, we are developing our Environmental Management System for our real estate and data center portfolios that is based upon the ISO 14001 structure. |